Sneaker Resellers Are Leaving Retail Consignment Shops, Trust is gone

Key points:

- High overhead costs passed to sellers

- Limited geographic reach

- Business fraud, bankruptcy and legal issues

- Trust issues with cash handling

METAZ Solution: No physical overhead, global buyers, instant settlement, transparent blockchain tracking

Sneaker Resellers Are Leaving Retail Consignment Shops

Physical consignment stores dominated sneaker resale for years. Walk in, drop off your Jordans, let the shop handle authentication and sales, collect your payout. Simple. Trusted. Until recently.

Consignment shops are closing and filing bankruptcy at an accelerating rate. Soleply closed four stores in 2025 after revenues dropped from $10.4 million to $8.8 million.

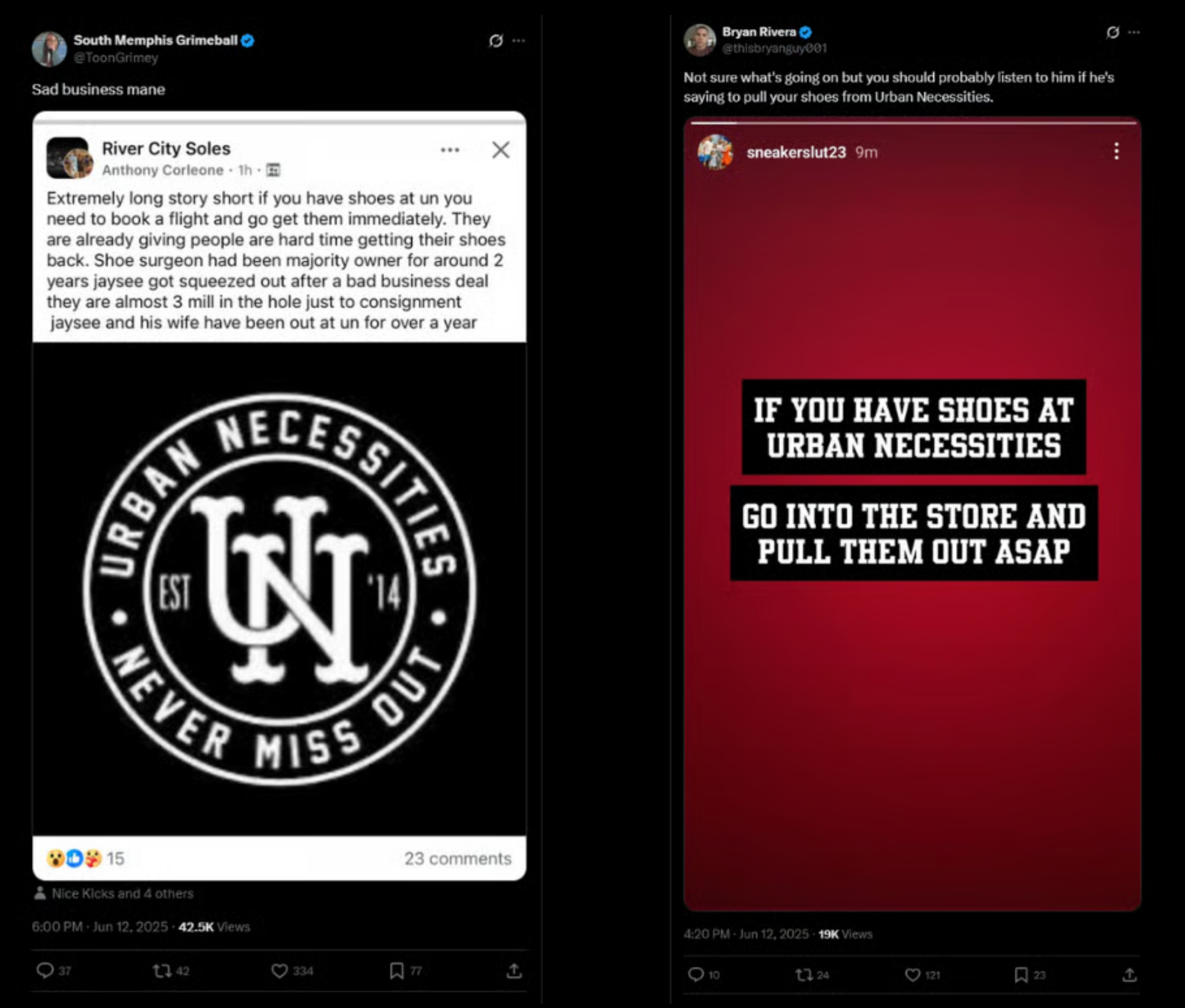

Meanwhile, Urban Necessities faced allegations of not paying dozens of consignees in 2025, with many reporting months-long payment delays and unanswered communications. The Las Vegas shop, once regarded as one of the world's most prominent sneaker consignment stores, became embroiled in a public dispute between founder Jaysse Lopez and new partners, leaving consigners caught in the middle.

Resellers are looking for alternatives.

The Overhead Problem

Physical retail economics don't scale with compressed margins. Stadium Goods charges 20% commission. Urban Necessities takes 10%+ or $20 (whichever is greater) plus $15+ in possible cleaning and storage fees. Flight Club extracts 9.5% + $5 + 2.9% cash-out fee.

These fees reflect real costs. Rent in high-traffic areas runs $15,000+ monthly in major cities (being conservative in the US). Staff salaries, utilities, insurance, security systems compound quickly. Consignment shops pass these costs to sellers because overhead stays fixed regardless of transaction volume.

When sneaker margins were strong, sellers absorbed the fees. Buy Dunks for $150, sell for $400, keep $320 after commissions. Still profitable. But margins compressed significantly. That same Dunk now sells for $180. After 20% commission, sellers net $144. They lost money on what should have been a profitable flip.

Physical overhead doesn't compress when margins do. The math stopped working for many resellers.

Geographic Limitations

Consignment shops serve local markets. A Los Angeles shop primarily sells to LA buyers, maybe some tourists. That's the addressable market.

This worked when demand was universal. Jordan 1 Breds sold everywhere. But markets fragmented. Asian markets favor different colorways than US markets. European buyers want different sizes. A physical shop can't efficiently access these global markets.

Inventory can sit unsold locally while buyers thousands of miles away would pay premium prices. Geographic constraints create inefficiencies that hurt both shops and consigners.

Trust and Payment Issues

Urban Necessities' situation revealed additional complications. Founder Jaysse Lopez claimed he was pushed out of the business by new partners after stepping back following personal issues, yet remained liable for company debts. Meanwhile, multiple consignees reported not receiving payment for sold items, with some waiting months while emails went unanswered.

Soleply's bankruptcy filing stated that high-interest, short-term debt used to fund store expansions created inventory shortages and cash flow instability. When margins tightened, the debt cycle became unsustainable.

The popular sneaker boutique BannedLA struggled to pay consigners. These situations show how consigners often bear risk while shops control their assets.

Inventory Velocity

Consignment timelines don't match modern market needs. Consignment shops lack incentive to discount stale inventory quickly. Shoes sit on shelves for months because the shop prefers waiting for their target price over moving volume. Meanwhile, consigner capital stays frozen in unsold inventory they can't access.

Volume resellers need fast turnover to maintain cash flow. Consignment timelines of weeks to months per sale don't support the velocity current resale margins require.

METAZ Can Rebuild Trust in Resale

METAZ addresses each challenge physical consignment faces:

Lower Overhead Costs: No retail rent, no authentication centers, no large staff. Climate-controlled vaults cost a fraction of retail space. These savings translate to 3% seller commission versus 20%+. On a $200 sneaker sale, traditional consignment nets $160. METAZ nets $194.

Global Market Access: Sneakers authenticated into our vaults instantly reach global buyers. Japan-based collectors and US resellers see the same inventory simultaneously. No geographic limitations. Rare sizes and regional preferences find their buyers regardless of location.

Transparent Blockchain Settlement: Every transaction records on-chain. Ownership transfers are public, permanent, and verifiable. When you sell a tokenized sneaker on METAZ, payment settles instantly through smart contracts.

Instant Inventory Turnover: Authenticate once, trade infinitely. Physical sneakers stay secure in vaults while digital ownership changes hands instantly.

Full Coverage (Policy Dependant): Vault storage includes comprehensive insurance covering all stored inventory. Your sneakers are protected whether sitting in storage or actively trading.

Looking Forward

The consignment model served the sneaker resale market when margins were high enough to subsidize inefficiency. Sellers could afford 20% fees with 100%+ profit margins. Shops could afford expensive retail space when inventory moved fast enough to cover rent.

Both conditions changed simultaneously. Margins compressed to 10-25% per pair while overhead stayed fixed. Physical retail in sneaker resale faces structural challenges that digital infrastructure naturally avoids.

Resellers are shifting to platforms with lower fees and faster settlement. Digital infrastructure offers operational efficiency physical retail can't match. Authentication happens once, not repeatedly. Storage is centralized and insured, not distributed across retail locations. Trading is instant and global, not slow and local.

METAZ provides the infrastructure modern sneaker resale requires: speed, efficiency, and global reach with minimal overhead costs passed to users.