In the rapidly growing sneaker resale market, cost-efficiency and profits have been crucial factors for both buyers and sellers. However, as the market has matured and begun to contract, a challenging dynamic has emerged. Platforms are faced with escalating costs to maintain their operations, leading to increased fees that make them increasingly expensive for buyers and sellers to use.

While platforms like eBay, GOAT, StockX, and others have established themselves and will likely survive due to their size and capital reserves, smaller, less capitalized companies are already shutting down their services. In this context, METAZ emerges as a compelling alternative. By leveraging a tokenized real-world-asset (RWA) model for sneaker investments, METAZ offers a fundamentally different approach with significantly lower fixed costs.

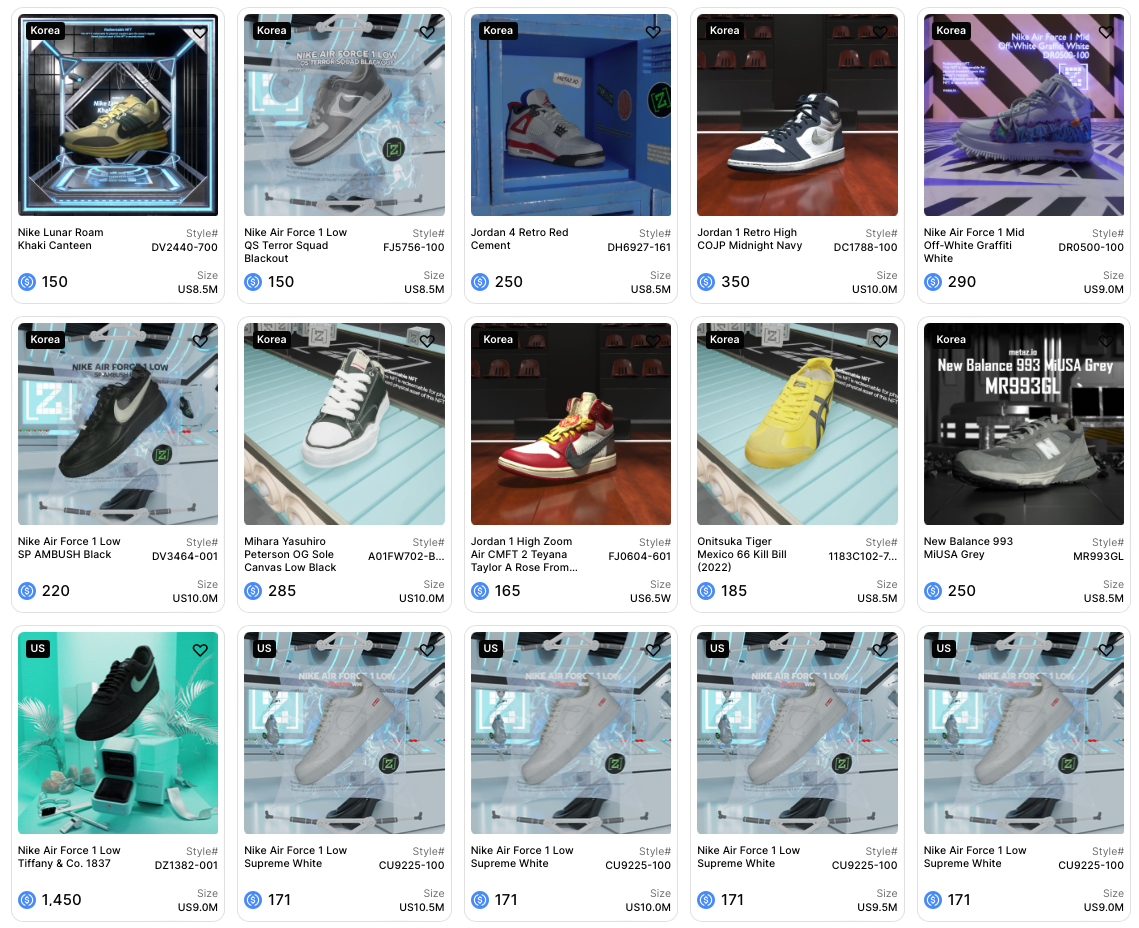

Sneaker Resale Platforms: 2024 Fee Comparison

As the sneaker resale market has grown, current web2 platforms are facing significant scalability challenges. These web2 platforms see costs spiral as they onboard more buyers, sellers, and inventory. These platforms include:

- Grailed: Online peer-to-peer marketplace

- StockX: Online peer-to-peer marketplace

- GOAT: Online peer-to-peer marketplace

- Stadium Goods: Retailer with a consignment model listing online and in-store

- Flight Club: Retailer with a consignment model listing online and in-store

- KLEKT: European peer-to-peer marketplace

- eBay: One of the first online peer-to-peer marketplaces

The table below shows most major platforms and resale platforms now charge double-digit cumulative fees.

| Platform | Fees |

|---|---|

| eBay | - 8% final value fee for sneakers over $150, 13.25% final value fee for sneakers under $150 |

| GOAT | - 9.5% commission fee, $5 seller fee, 2.9% cash out fee |

| StockX | - 9% transaction fee, 10% payment processing fee |

| Stadium Goods | - 20% consignment fee |

| Fight Club | - 9.5% consignment fee & $5 USD commission |

| KLEKT | - 17% fee on top of seller's payout price |

| => METAZ | - 3% seller's fee, 0% processing fees |

Key advantages of METAZ is not only its fixed 3% seller's fee but also:

- Free custody service and secure storage of your collectible sneakers in our monitored, temperature-controlled vault

- Instant cross-border transactions

- Secure storage safeguarding the condition of the physical sneakers

What Makes METAZ Different?

METAZ is disrupting the resale market by tokenizing Real-World Assets (RWAs) like sneakers on-chain. This tokenization not only streamlines the complicated processes but also eliminates physical handling, reducing risks for platforms and users.

With fixed 3% transaction fees regardless of volume, METAZ ensures affordability and predictability, unlike traditional platforms. Tokenization enables borderless trading, optimal price discovery, and programmable asset capabilities, maximizing the value of sneaker collections.

Why Are Costs/Fees Higher on Tradition Resale Platforms?

Those that have been observing the sneaker resale market have noticed a year-over-year increase in fees - whether it's commissions or processing fees, these platforms are getting more expensive to use. The reason for the increase in fees is a combination of decreased profits and high overhead costs.

On the profit side, demand is decreasing while supply is increasing. Nike has pumped out Jordan 1s and Dunks like never before and Adidas has also flooded the market with millions of sneakers. Previously profitable sneakers are now trading much lower than their peaks in 2021, leading to drastically decreased profits for both resellers and platforms.

Additionally, the resale business has inherently high overhead costs stemming from inefficient processes like repeated authentication checks and shipments every time a sneaker changes hands. The handling of physical inventory also carries the risk of potential damage.

Conclusion

As oversupply, market saturation, and fatigue have crushed profitability, traditional platforms are burdened with high costs stemming from handling physical inventory and facilitating peer-to-peer transactions.

As a result, consumers are more wary about where they transact, even more so with their sneakers. In this challenging environment, tokenized real-world sneaker assets present an opportunity to streamline operations, reduce friction and fees, and unlock new capabilities. METAZ's tokenized sneakers could pave the way for a more accessible and efficient sneaker economy.

Ready to start your collection hassle-free?

Check out our marketplace: https://metaz.io/explore

Custody your sneaker collection: https://metaz.io/custody

Join our community: https://discord.gg/metaz