In 2020, 58% of sneaker releases traded above retail. By 2024, that dropped to 47%. StockX valued the resale industry at $6 billion in 2019, forecasting $30 billion by 2030. But Nike oversaturated Dunks. Adidas flooded the market. Margins collapsed from 100%+ to 10-25% per pair.

Flippers needed immediate returns. When margins compressed, they left. But the market correction exposed something valuable: it's now a buyer's market for serious collectors.

Prices stabilized closer to intrinsic value. Hype premiums disappeared. Rare colorways and limited collaborations still command premiums, but general releases trade near retail. Travis Scott x Jordan collabs averaged $451 resale in 2024, a 197% markup. Quality still performs. Everything else normalized.

This creates collecting opportunities flippers ignored. Buy what you actually want at fair prices. Hold through market cycles. Let appreciation happen naturally rather than chasing quick flips.

Why Alternative Assets Appreciate

Sneakers joined art, watches, and classic cars as legitimate alternative assets. These markets share characteristics: tangible value, cultural significance, limited supply, and low correlation with traditional markets.

Art has historically returned 8.5% annually from 1950 to 2021. Classic cars returned 280% from 2008 to 2021, outperforming the S&P 500. The global art market generates $65 billion annually. Luxury watch collectors typically hold 3-10 years, waiting for values to mature.

Sneakers follow similar patterns. Limited production. Cultural relevance. Tangible assets with intrinsic value. The difference was infrastructure. Art investors use platforms like Masterworks for fractional ownership and professional curation. Watch collectors use specialized marketplaces with authentication, insurance, and storage.

Sneaker collectors lacked this. They stored inventory in closets risking damage. Paid platform fees of 10-19% every transaction. Absorbed international shipping, VAT, and customs costs. The infrastructure gap prevented serious collecting.

The Cost Structure That Killed Collecting

Traditional platforms make long-term holding expensive. Storage costs $100-150 monthly for climate-controlled units. A collector managing 200 pairs spends $1,200-1,800 annually just warehousing inventory.

Platform fees compound. Buy a $200 sneaker, pay 10-19% to sell it ($20-38). Want to rebalance your collection? Another 10-19% fee. Each transaction bleeds value.

Selling 10 sneakers for $1500 on #StockX?

— METAZ (@metaz_io) November 21, 2025

See how much more you can make with METAZ 👇 pic.twitter.com/wYXEN2oiTC

International collecting faces worse economics. European collectors buying US releases pay 20% VAT plus 10-15% customs duty. A $1,000 sneaker costs $1,300-1,400 after taxes. Asian markets pay premiums for certain colorways, but shipping and duties make accessing those markets impractical for most collectors.

Authentication delays add another cost. Wait 2-4 weeks for verification while prices move. During market spikes, that delay costs profits. During corrections, inventory depreciates while sitting in queues.

These costs made collecting inefficient. You couldn't hold sneakers long-term without storage overhead. You couldn't trade globally without prohibitive taxes. You couldn't rebalance positions without bleeding fees.

Collecting Without Borders or Fees

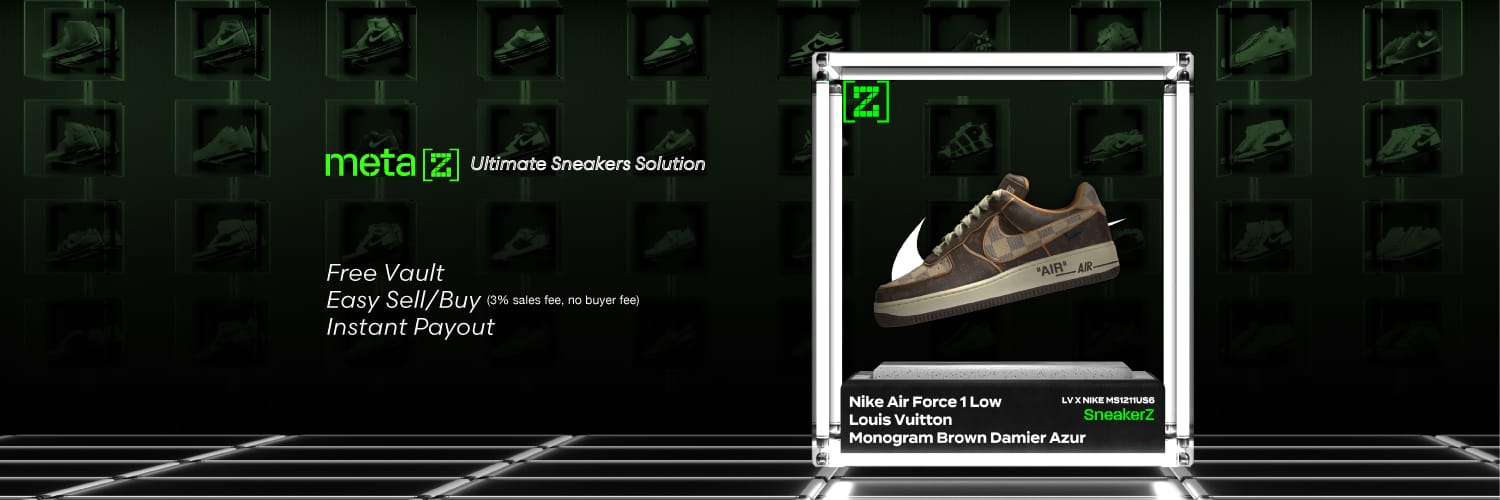

METAZ removes the friction that prevented serious collecting.

Free Professional Storage: Climate-controlled vaults with comprehensive insurance. No monthly fees. Store 50 pairs or 500 pairs, costs nothing. Sneakers maintain value through professional preservation rather than degrading in closets.

For collectors managing 200 pairs, that's $1,200-1,800 saved annually. Money that can buy more sneakers instead of paying rent on storage units.

3% Transaction Fees: Traditional platforms charge 10-19%. METAZ charges 3%. On a $200 sneaker, that's $6 instead of $20-38. Rebalance your collection 10 times, save $140-320 in fees.

When you're collecting for appreciation rather than quick flips, minimizing transaction costs matters. Every dollar saved in fees is a dollar preserved in your collection's value.

No International Barriers: Digital ownership eliminates VAT, customs, and shipping costs during trading. European collectors and US collectors see identical pricing. Asian markets pay premiums for certain sizes and colorways. Access those markets without 30-40% tax and duty overhead.

Taxes only apply if someone redeems the physical sneaker from the vault. While trading digital ownership, no geographic costs exist. A Japan-based collector can buy from a US seller, hold for appreciation, then sell to an EU buyer without anyone paying international fees.

This opens collecting strategies physical platforms can't support. Regional arbitrage becomes practical. Building a globally diversified collection costs the same as building a domestic one.