The world of sneaker collecting has evolved from a niche hobby to a multi-billion dollar industry. For many, sneakers have transcended their utility as footwear and have become coveted assets.

However, the traditional methods of investing in sneakers have their limitations (traditional sneaker reselling platforms have limitations too!). Reselling, the act of purchasing sneakers at retail prices and flipping them for a profit, have been a popular strategy, but is often bogged down by the physical nature of asset.

Tokenization of real-world assets (RWAs) offers a potential solution by representing ownership rights as digital tokens on the blockchain - unlocking new options for sneaker investing, while also addressing the limitations of traditional resale.

Traditional Way of "Investing" in Sneakers

Resale. The act of reselling of a shoe at a higher price than what you initially paid of them at the retailer, online, or from another collector. For example, if you purchase some Yeezy slides for $70 and are able to resell them for $100, your profit is $30 or 42.9% ROI. Compare that with a U.S. index fund, that averages a return of 10.26% per year since its 1957 inception through the end of 2023. It isn't hard to imagine that a sneaker 'investor' or 'reseller' can make a living from just buying and selling sneakers.

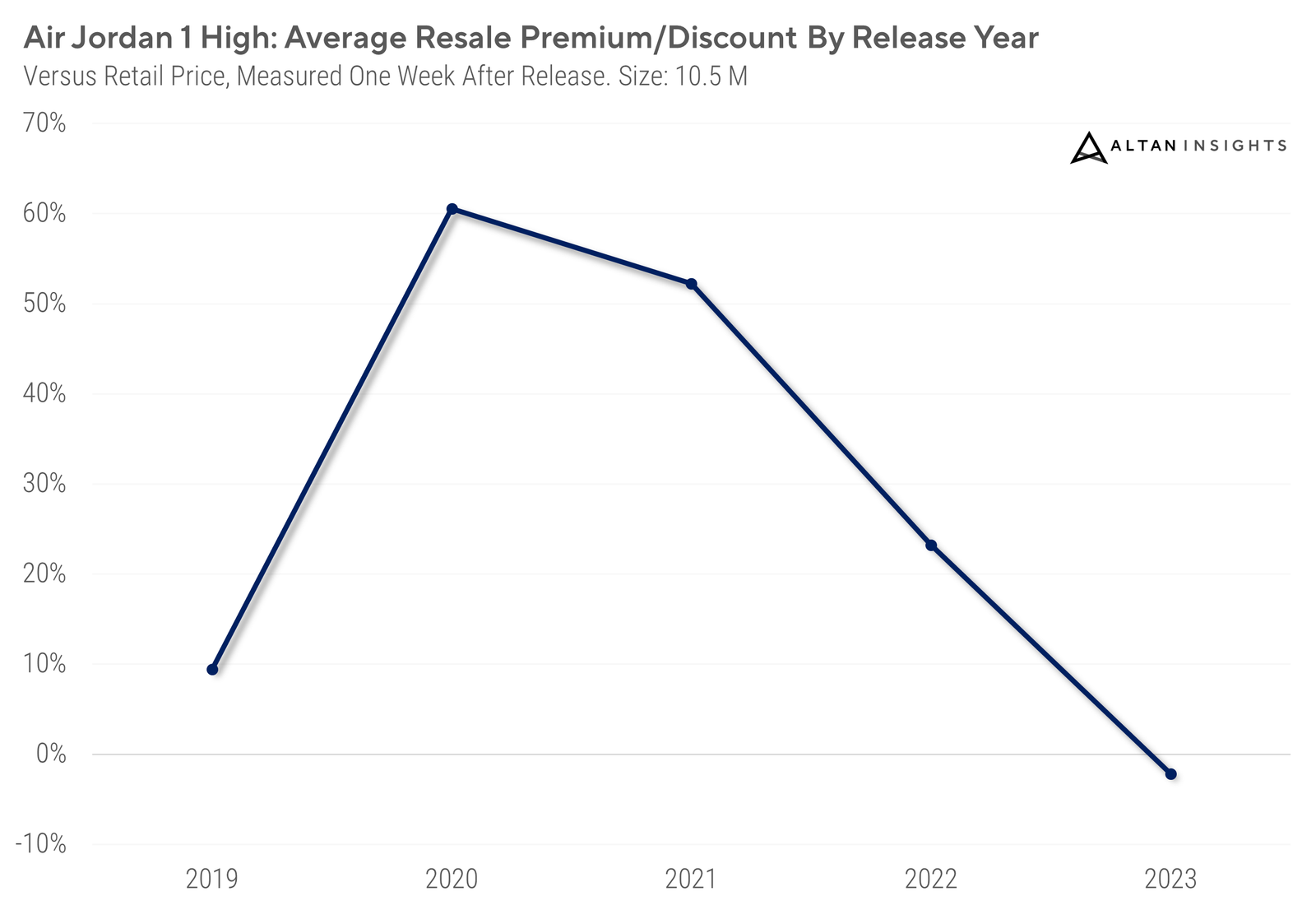

This type of investing has been quite attractive the past couple of years during the sneaker hype cycle (More specifically, from 2019) due to how simple it was to get started and how much demand was out there for certain sneakers. All you really had to do was purchase a pair of sneaker at your favourite retailers' site and resell it for a profit either locally or on platforms such as StockX or eBay.

However, as the sneaker market cooled off, investors, resellers, collectors, and even resale platforms themselves have started to question the viability of the market. This is due to a number of factors but the main factors being:

- Post pandemic inventory oversupply

- Less demand and more competition

- Lower profitability and increased costs

Thus, collectors trying to monetize their collection and resellers trying to book profits are facing a dilemma if they need to liquidate to survive the downturn or pay operating costs. For sneakers to solidify their status as a legitimate alternative asset class alongside art and other collectibles, innovative solutions are necessary to address the limitations and challenges of traditional investing methods.

Tokenization of Sneakers as Real World Assets

There has been a surging interest in the tokenization of real-world assets as the convergence of traditional investments and the digital realm accelerates. As this concept approaches maturity, it is being increasingly applied to various asset classes, including bonds, commodities, and collectibles like sneakers.

The tokenization of real-world assets entails creating digital tokens that represent the ownership rights of those physical assets on the blockchain. This process involves generating a digital representation of the underlying asset, allowing the management of ownership rights and transfer of those rights to occur on the blockchain. Essentially, it establishes a link between the physical and digital realms for the given asset.

Expanded Opportunities with Tokenized Sneakers

Not only do tokenized assets have all the benefits of digitization (instant transactions, low fees, etc.) but also greatly expands the ways users can invest in sneakers:

- Programmable and integrable within DeFi protocols and financial products (i.e. collateralized lending/borrowing, futures/options, and more). Let's say you own a pair of Air Force 1 '07 sneakers that you really like but don't necessarily want to sell. On Meta[Z], these sneakers would be tokenized as a unique NFT.

This NFT represents your verifiable ownership of the physical Air Force 1 sneakers on the blockchain. Even though they aren't an ultra-rare pair, the NFT still holds value. You could then use this NFT sneaker as collateral which allows you to take out loans.

For example, if your Air Force 1 NFT was valued at around $100 on the platform, you could potentially put it up as collateral and receive a loan of $50 (50% LTV) in a cryptocurrency. You'd continue to physically possess the Air Force 1 sneakers, but the NFT representing ownership would be locked as collateral until you repay the $50 loan plus any interest or fees.

If the value of the NFT sneaker appreciates over time, you may be able to borrow more against it or retrieve it after repaying the original loan amount (and keep the additional profits from the sneaker appreciating).

Alternatively, you could even open a leveraged long or short position on the price movement of that sneaker NFT. For example, you could put up $100 worth of crypto as margin to open a 5x leveraged long position on your Air Force 1 '07 sneakers. This allows you to essentially "go long" on $500 worth of the NFT's value.

If the NFTs value increase to $200 on the platform, you could close that 5x leveraged long position for a $500 profit (5 x $100 margin). Essentially getting 5x exposure to the $100 price increase without selling the asset itself. Of course, you could also open a leveraged short position if you believe the NFT's value would decrease. Useful for covering your asset's value during a market downturn. - Expensive grail sneakers can be potentially offered as a STO (Security Token Offering) to allow fractional ownership for increased accessibility and affordability.

If you own a pair of extremely rare and valuable sneakers, like the Nike Air Mag from Back to the Future. Instead of keeping them locked away with no way to monetize them aside from an outright sale, you could tokenize them on a platform like METAZ.

The sneakers can potentially be represented by a specific number of non-fungible tokens (NFTs) or digital tokens, with each token representing a fractional ownership stake in the physical sneakers.

You could then sell or trade a portion of those tokens, say 10%, on a decentralized marketplace. This would allow you to unlock some of the value and liquidity from your sneaker asset without having to part with the entire pair.

Other investors could purchase those 10% tokens, giving them a fractional ownership stake. They would then potentially benefit if the value of the tokenized sneakers appreciates over time. Meanwhile, you still own 90% of the tokens and maintain majority ownership of the physical sneakers. This gives you the flexibility to hold the asset long-term while also accessing liquidity by selling off a portion as tokens when needed.

Simply put, it allows users monetize or access liquidity from their sneaker assets without selling their assets and without risking its physical integrity (crucial to the value of collectible assets).

Conclusion: Beyond Resale, Destination Meta[Z]

Tokenized sneakers offer opportunities beyond resale. It serves as the main way to democratize the sneaker marketplace, making collectible sneakers accessible to more people globally while also unlocking the liquidity that it needs.

The Meta[Z] platform, plans on building all of these methods and more to the future of sneaker investing and collecting. Through tokenization, sneakers can be integrated with decentralized finance (DeFi) protocols, enabling collateralized lending, leveraged trading, and fractional ownership. These options provide liquidity and exposure without necessitating the outright sale of physical assets, preserving their integrity and potential appreciation.

As the concept of tokenized RWAs continues to gain traction, the future of sneaker investment lies not in just conventional resale, but also in tokenized assets. Collectors and investors alike can explore new avenues for monetizing their passion, while also unlocking previously untapped opportunities for portfolio diversification and value appreciation.

Ready to start your collection hassle-free?

Check out our marketplace: https://metaz.io/explore

Custody your sneaker collection: https://metaz.io/custody

Join our community: https://discord.gg/metaz