The sneaker resale market, once defined by sky-high premiums on limited-edition drops, is at a crossroads. Recent data suggests it’s not fading but transforming, driven by economic shifts, changing consumer preferences, and oversupply.

Is this a decline, or an opportunity for resellers to adapt? This article examines the market’s evolution and how platforms like METAZ empower resellers to thrive in this new landscape.

A Market in Transition

The sneaker resale market remains robust, with projections estimating a $30 billion valuation by 2030 (Schwartz, 2024, StockX CEO Quote). However, its dynamics are shifting.

In 2020, 58% of sneaker releases traded above retail on secondary platforms, but by 2024, this fell to 47% (StockX, 2024, Footwear News: Sneaker Resale Decline or Shift?).

Profit margins are tightening as economic pressures, including inflation, push consumers toward affordable options like Nike Dunks or Adidas Sambas, which resellers now sell in volume for $10–$25 profits per pair (Simms, 2024, GOAT Market Report).

Retail oversupply is a key driver. Brands like Nike have flooded stores with inventory, reducing scarcity and resale premiums, making it easier to snag hyped releases at retail (Stadium Goods, 2024, Stadium Goods Closing NYC Store).

Yet, high-demand drops like the Travis Scott x Jordan collaboration still fetch $451 on average—a 197% markup—proving select releases retain value (StockX, 2024). Meanwhile, brand diversification is reshaping the market. Anta’s sales surged 1,901% on StockX, Asics retro styles grew 645% on GOAT, and women’s sneakers, like Nike Sabrina models, jumped 707% in 2024, signaling new niches for resellers (StockX, 2024; GOAT Group, 2024).

Challenges and Opportunities for Resellers

These shifts challenge traditional reselling. Tighter margins force a pivot to volume-based strategies, with resellers buying hundreds of pairs to offset lower profits.

Staying ahead requires spotting trends—like the rise of Anta or women’s sneakers—while managing storage and shipping costs. Platforms charging high fees, such as eBay (up to 13.25%) or StockX (19%), further erode earnings, pushing resellers to seek efficient alternatives.

METAZ: Capitalizing on the Shift

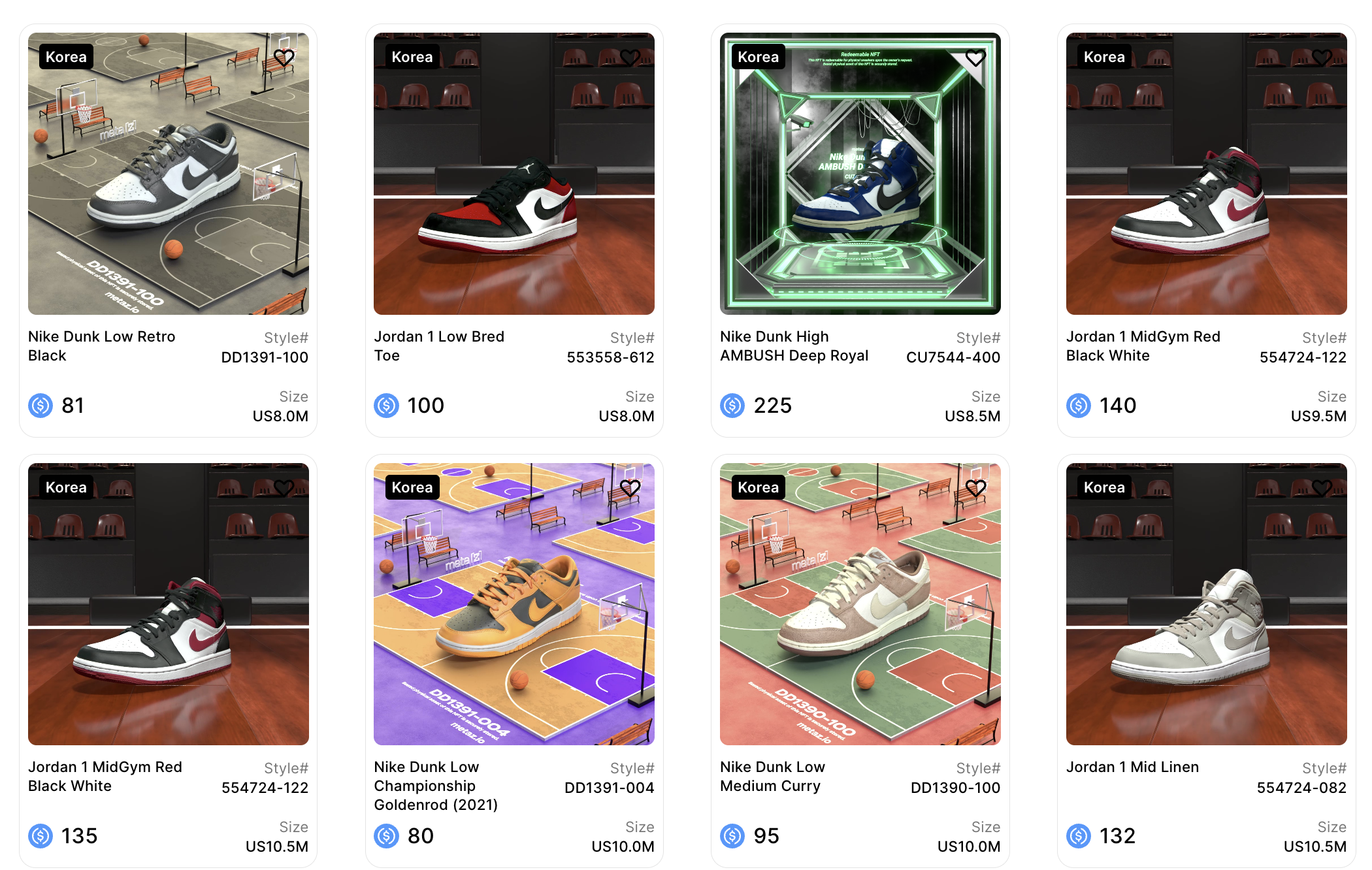

METAZ offers a tailored solution for resellers navigating this market. Its Sneaker Custody service provides free, climate-controlled storage, protecting sneakers from damage and freeing up space—a critical advantage for bulk resellers (METAZ Blog: Free Sneaker Custody).

By tokenizing sneakers, METAZ enables instant global trading as digital assets, bypassing physical shipping delays and costs. With a 3% seller’s fee—far below competitors—resellers keep more profit, vital in a low-margin environment (METAZ Blog: METAZ vs. Sneaker Resale Fees).

METAZ’s global marketplace lets resellers tap international demand, crucial when US premiums soften. Tokenized trading ensures flexibility, allowing quick sales to capitalize on trends like women’s sneakers or emerging brands (METAZ Blog: What Are Tokenized Sneakers?).

Conclusion

The sneaker resale market isn’t declining—it’s shifting toward volume, diversification, and new demographics. Resellers who adapt by targeting affordable sneakers, embracing new brands, and leveraging cost-effective platforms will find opportunities.

METAZ stands out by reducing fees, streamlining global trading, and solving storage woes, empowering resellers to profit in this dynamic era. Explore how METAZ can elevate your resale game at blog.metaz.io or visit metaz.io.

Official Links:

Sneaker Resale Marketplace: https://metaz.io/explore

About Sneaker Custody: https://metaz.io/custody

Join Our Sneaker Community: https://discord.gg/metaz