The sneaker world was recently rocked by the sentencing of Michael Malekzadeh, the owner of Zadeh Kicks, to 70 months in prison for a fraud scheme totaling over $80 million.

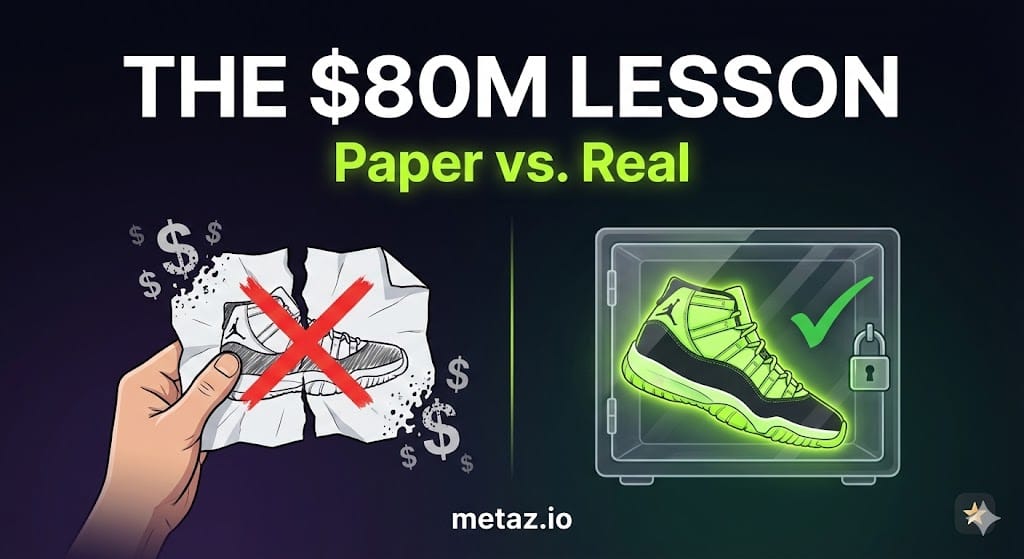

For years, Zadeh Kicks was seen as a titan of the industry. But behind the scenes, the business was built on a house of cards. The mechanics of this collapse offer a harsh lesson for collectors and investors: If you can't verify the asset, you don't own it.

Here is why the "Zadeh Model" failed, and how the METAZ Model ensures it can never happen to you.

The "Pre-Order" Fraud

The Zadeh Kicks fraud was fueled by the "pre-order" concept. Malekzadeh accepted payment for sneakers he did not yet have, banking on his ability to source them later.

The scale of this disconnect was staggering. For the release of the Air Jordan 11 Cool Grey in 2021, Zadeh Kicks accepted 600,000 preorders totaling $70 million. The reality? He had only secured 6,000 pairs.

He was effectively selling "paper sneakers"—collecting millions for inventory that didn't exist. When the math finally caught up with him, thousands of customers were left with nothing while he funded a lavish lifestyle of Bentleys and Ferraris.

The METAZ Difference: 1-to-1 Backing

At METAZ, we built our infrastructure to solve exactly this problem. We do not deal in pre-orders, promises, or "incoming inventory." Our custody system is designed on a strict 1-to-1 basis:

1. Verification First: A sneaker cannot be listed on the METAZ marketplace until it has physically arrived at our custody centre and been verified by our team.

2. The Vault Lock: Once verified, the sneaker goes into our vault—managed by top-tier logistics partners like MXN Technologies—and is assigned a unique identifier.

3. Token Creation: Only after the physical item is secured is the digital token created.

This means it is technologically impossible to sell 600,000 tokens for 6,000 sneaker. On METAZ, if you see a sneaker on our marketplace, the physical sneaker is already sitting in the vault.

From "Trust Me" to "Trust the Vault"

The Zadeh Kicks scandal proves that the old way of doing business—trusting a reseller's reputation—is broken. "The industry professionalized because it had to".

Investors today need more than a receipt; they need proof of reserves. By separating the financial transaction from the physical storage, we ensure that "ownership transfers instantly" without the risk of a vendor running off with your capital.

Don't bet your portfolio on a pre-order. Buy assets that actually exist.