METAZ eliminates authentication delays entirely through a different model: trade instantly through digital ownership.

How It Works

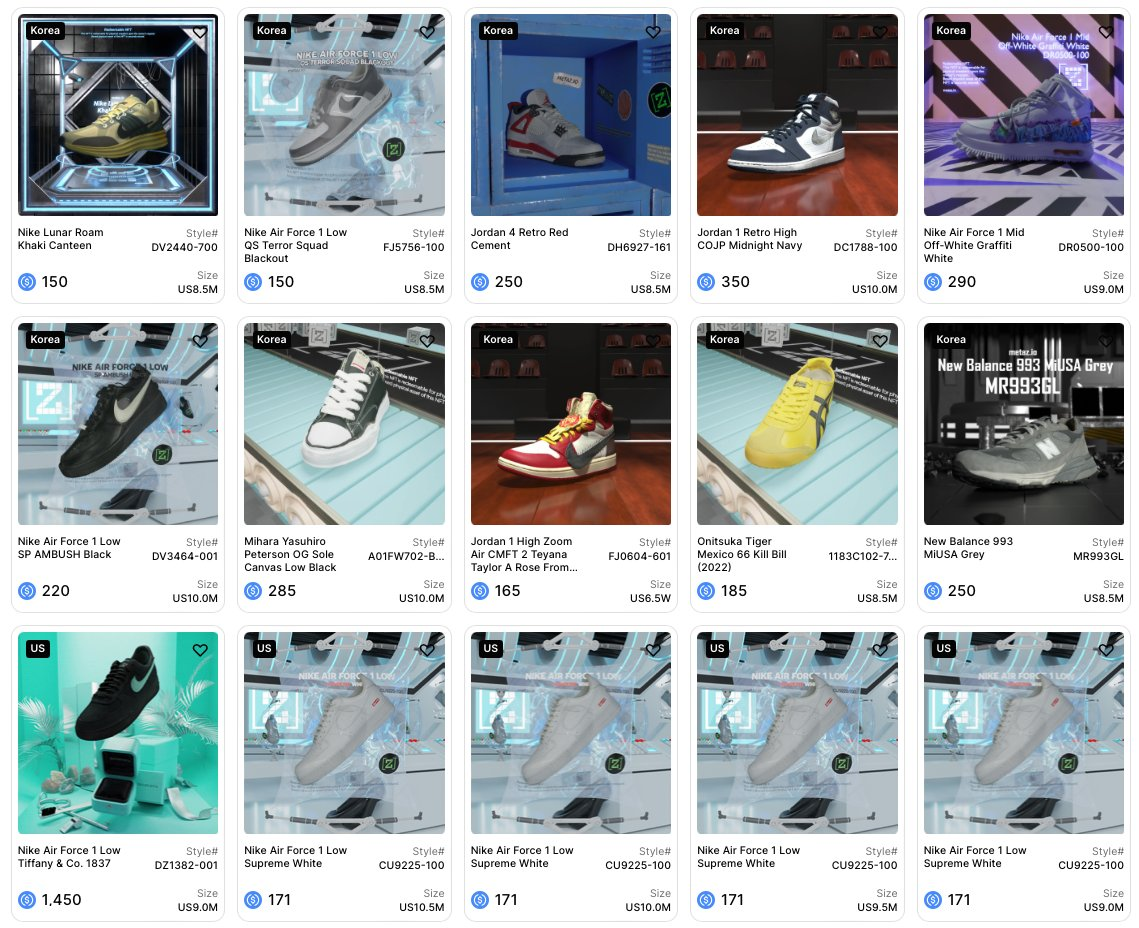

Sneakers entering METAZ's climate-controlled vaults get authenticated on arrival. After that single verification, they trade digitally with zero authentication delay. No waiting for verification between trades. No watching prices drop while items sit in queue. No capital locked up for weeks.

When a user buys a tokenized sneaker on METAZ, ownership transfers instantly. Want to flip it an hour later because the market spiked? Go ahead. The physical sneaker stays secure in the vault while digital ownership changes hands in real-time.

Built For Volume Resellers

This model solves the exact problems modern resellers face:

Capital Velocity: Sell at 9am, buy the next flip at 9:05am. No waiting weeks for funds. No missed opportunities because money sits frozen.

Price Capture: When Travis Scott Jordan 1s jump 15% quickly, METAZ users can sell immediately and capture that spike. StockX sellers watch it happen while their pairs sit in authentication.

Operational Simplicity: No tracking items across authentication stages. No warehouse space for inventory in verification limbo. Everything authenticated once, traded infinitely.

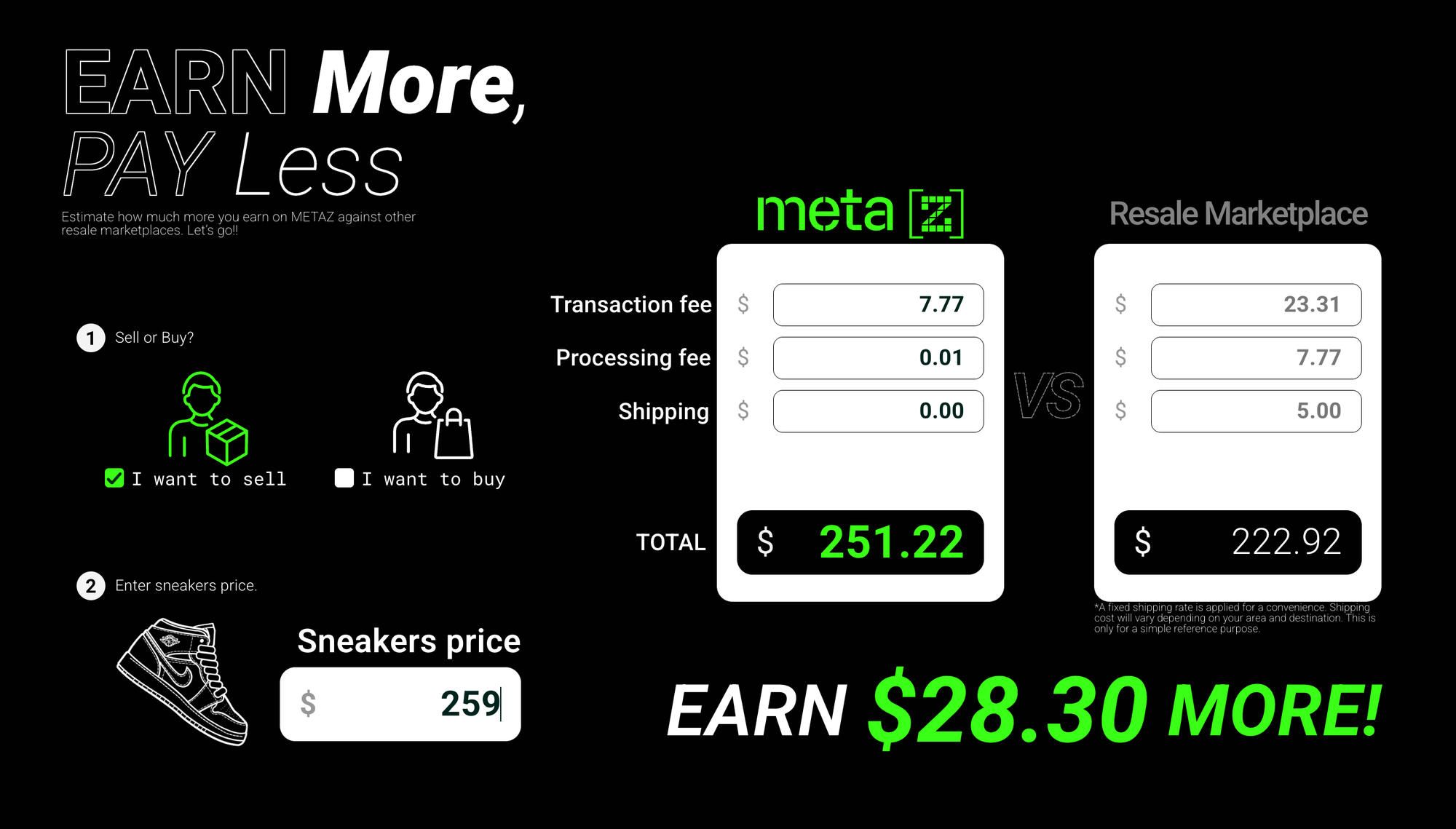

Fee Efficiency: METAZ charges 3% seller fees versus StockX's 10%+ take rate. On a $259 sale where StockX extracts $65 in total fees, METAZ takes $7.77. When margins dropped from $300 flips to $10-25 per pair, that difference matters.

Speed Is Everything

Volume resellers adopted sophisticated operations, diversified inventory, and moved to faster sales channels because authentication delays killed their old model. But those adaptations are workarounds for a fundamental problem: physical authentication creates bottlenecks.

METAZ's tokenization model removes the bottleneck entirely. Authenticate once, trade at market speed.

The sneaker resale game changed. Success now requires operational efficiency, speed, and capital velocity. StockX built infrastructure for a different era—when margins were fat enough to absorb delays, fees, and opportunity costs.

The resale market rewards speed now. And tokenization is faster than physical authentication will ever be.