In recent years, there has been a growing interest in alternative investments beyond traditional asset classes like stocks and bonds. One emerging alternative asset class capturing attention is sneakers, with rare and limited-edition models commanding staggering prices on the resale market.

For crypto natives accumulating digital assets, on-chain collectibles present an opportunity to diversify portfolios. By obtaining these RWA (Real World Asset) backed assets on the blockchain, they can gain exposure to an alternative asset class with potentially uncorrelated returns from volatile crypto markets.

Sneaker Culture and Collectibility

The sneaker industry has transformed into a cultural phenomenon driven by fashion, art, and celebrity influences. Limited releases and innovative designs fuel collector frenzy, driving demand for exclusive models.

As the sneaker resale market continues to grow, several factors contribute to the attractiveness of sneakers as an alternative investment vehicle:

- Illiquidity Premium: Rare sneakers are relatively illiquid due to scarcity and limited supply. This illiquidity can translate into higher potential returns for patient investors.

- Portfolio Diversification: The resale market is driven by distinct factors like consumer trends and pop culture. Returns from investing in rare sneakers may be largely uncorrelated with traditional asset classes, providing diversification benefits.

- Favorable Risk-Reward Profile: While investing in sneakers carries risks like damage or changing preferences, the potential rewards are significant. Scarcity and collectibility can drive substantial price appreciation over time.

Diversified and Uncorrelated Returns

Approximately $1.2 trillion, a staggering 0.4% of global wealth, was stored on the blockchain in 2023 - this number is set to more than double this year at over $3 trillion.

This immense amount of on-chain wealth presents holders with two fundamental options: either preserve these digital assets as a long-term store of value or explore opportunities to diversify and exchange their holdings into other asset classes and investment vehicles.

For crypto natives intimately familiar with the volatile nature of cryptocurrency markets, diversification into potentially non-correlated assets becomes crucial. This concept of constructing resilient, diversified portfolios capable of withstanding market fluctuations while generating consistent returns is widely embraced by institutional investors.

Similar to other collectible markets such as art or luxury watches, the sneaker resale market is driven by factors like cultural trends, consumer behaviour, and the intricate interplay of supply and demand for rare, limited-edition models.

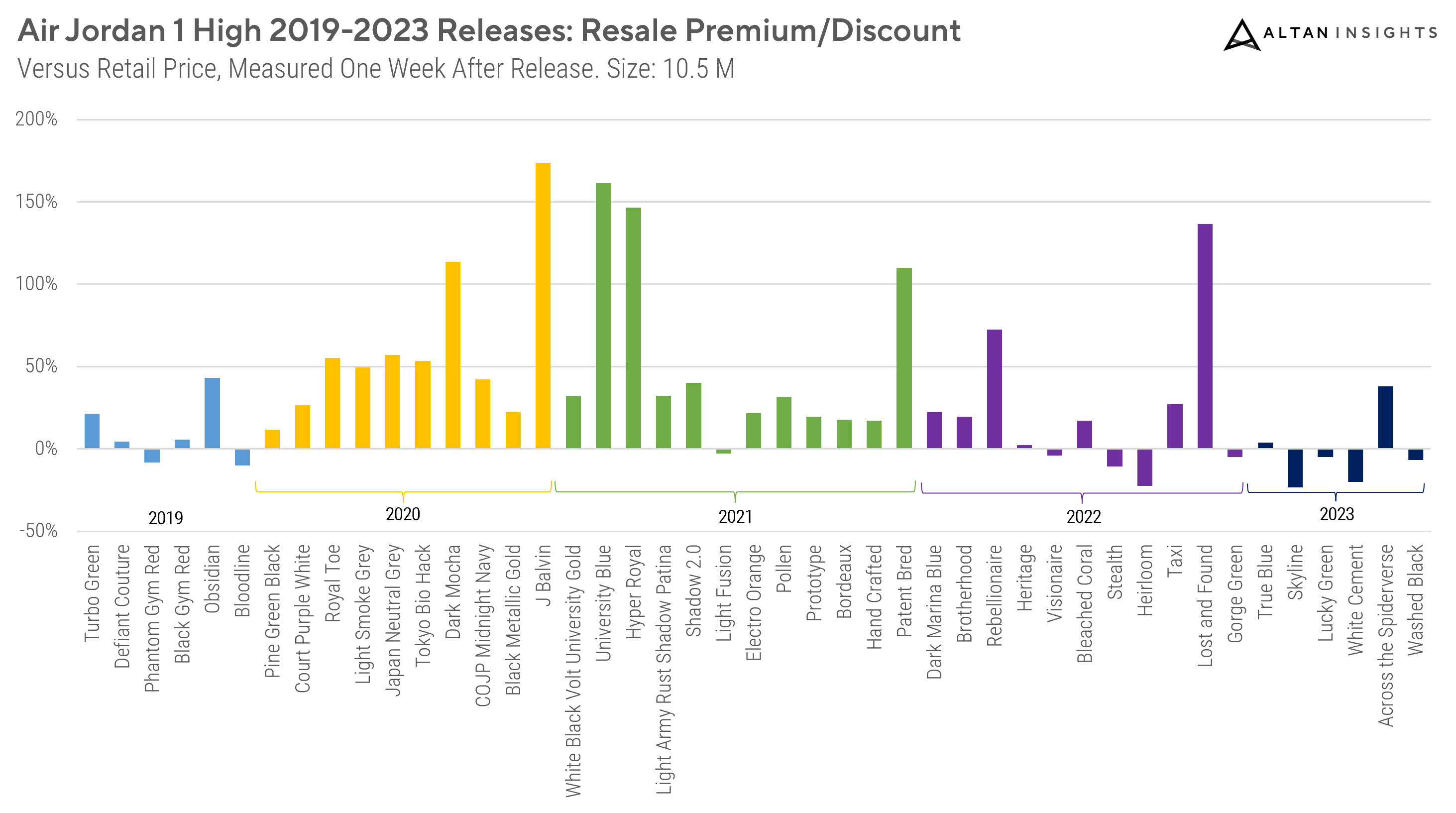

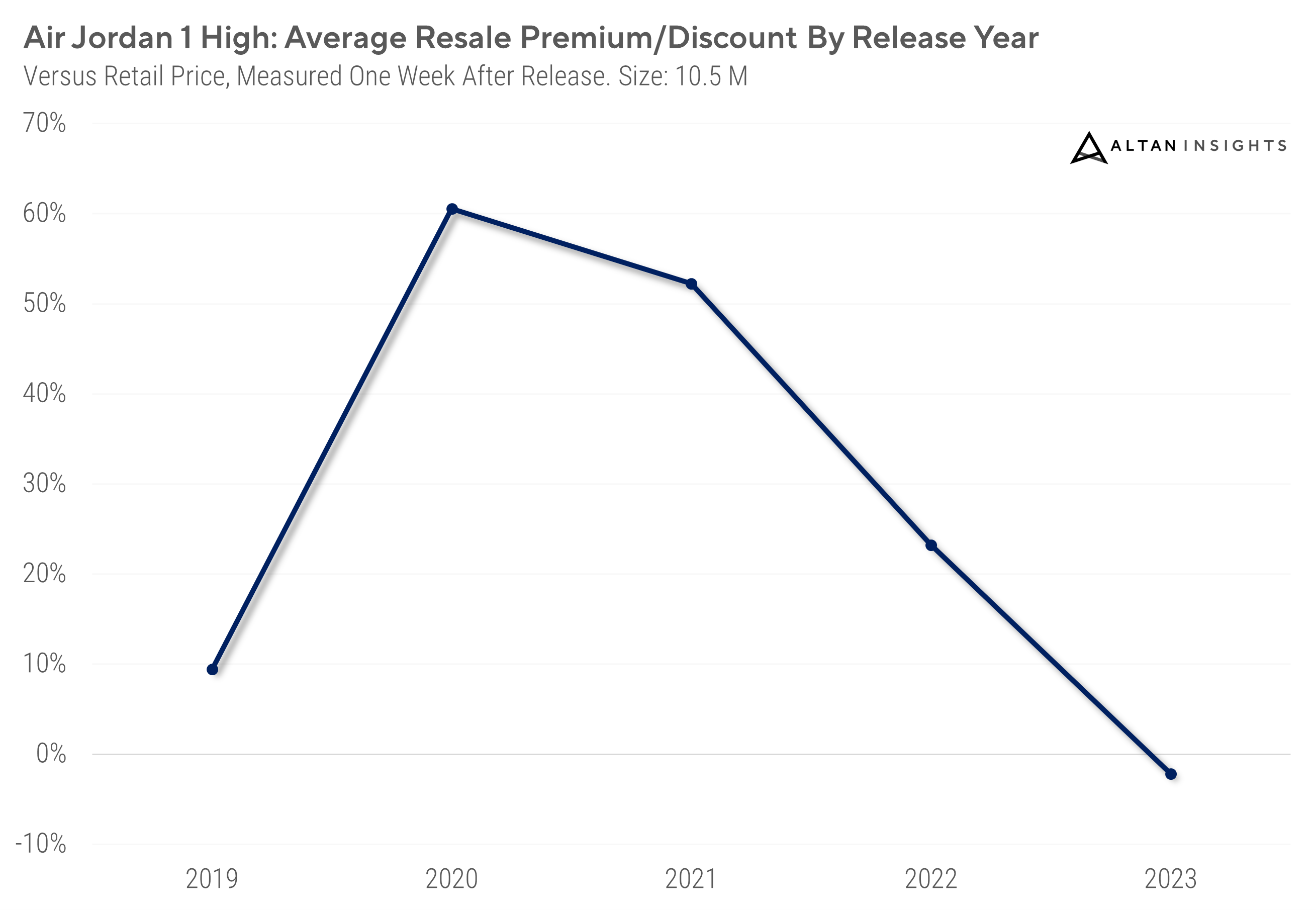

As evident from the provided data, even during the sneaker market cooldowns, rare sneakers have historically maintained significant premiums over retail prices or have seen relatively moderate declines compared to their initial resale values.

Current Challenges in Sneaker Investing

However, the current methods of investing in physical sneakers faces a few fundamental hurdles:

Accessibility - Extremely limited quantities of coveted releases made acquisition through regular retail channels difficult. The fragmented secondary market, with informal transactions, increased counterfeiting and fraud risks.

Authentication - Platforms and investors relying on costly and repeated expert services to authenticate physical assets, adds complexity and expense.

Asset Management - Proper storage and preservation of these physical collectibles required specialized, costly facilities and ongoing maintenance. Their physical nature also limits liquidity, hindering easy buying and selling.

METAZ: Onchain Sneakers as Real World Assets

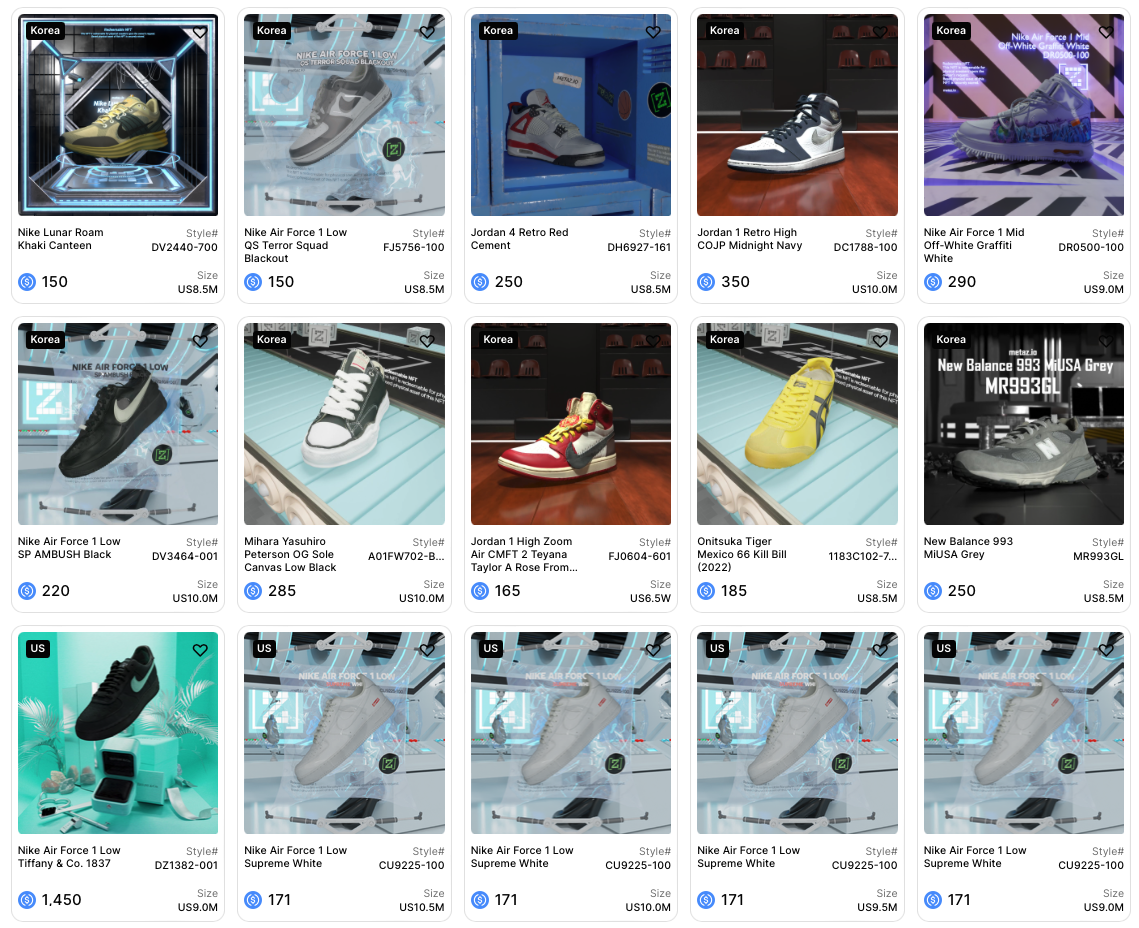

Meta[Z] provides a scalable solution for unlocking the full investment potential of collectibles such as sneaker assets. These on-chain sneakers are digital representations of the real assets, minted as non-fungible tokens (NFTs) on the blockchain - while their physical counterpart is securely stored in the Meta[Z] vault.

Meta[Z]'s custody service inspects and vaults sneakers to maintain the ideal conditions to secure your assets. This protects against degradation from heat, moisture, mold, and minimizes mistakes from mishandling and accidents.

One of the most significant benefits of on-chain sneakers is the increased liquidity they offer. Unlike traditional physical sneaker assets, which are often illiquid and difficult to trade, on-chain sneakers can be bought, sold, and even borrowed against, providing investors with greater flexibility and access to a global market.

Other key benefits include:

- Instantaneous cross-border transactions and a truly global market unrestricted by location

- Secure storage safeguarding the condition of sneakers (and their boxes!)

- Ultra-low trading fees maximizing earnings for buyers and sellers - compare fees against current Web2 platforms!

- Much lower risk of shipping delays, losses or hassles with transferring physical sneakers

Want to know more how METAZ can supercharge your sneaker collection? Read here.

Conclusion

Crucially, on-chain sneakers provide crypto natives with exposure to an alternative asset class that is potentially uncorrelated with the volatile crypto markets.

By investing in these tokenized assets, investors can mitigate portfolio risk and enhance overall resilience, aligning with fundamental investment principles of diversification and uncorrelated returns. Not to mention, be involved with the culture, fashion, and art that is collectable sneakers!

Ready to start your collection hassle-free?

Check out our marketplace: https://metaz.io/explore

Custody your sneaker collection: https://metaz.io/custody

Join our community: https://discord.gg/metaz

![Meta[Z]: Unlocking Sneakers as Alternative Assets](/content/images/size/w1200/2024/05/Untitled-5.png)