The sneaker resale market has undergone significant changes from 2023 to 2024, with emerging trends indicating a more challenging environment for resellers. Let’s dive into key insights and explore the implications for profitability in this evolving market, drawing from StockX's Resale Report for both years, alongside insights from Chris Burns of arch-usa.com.

2023 VS 2024 Resale Trend Analysis

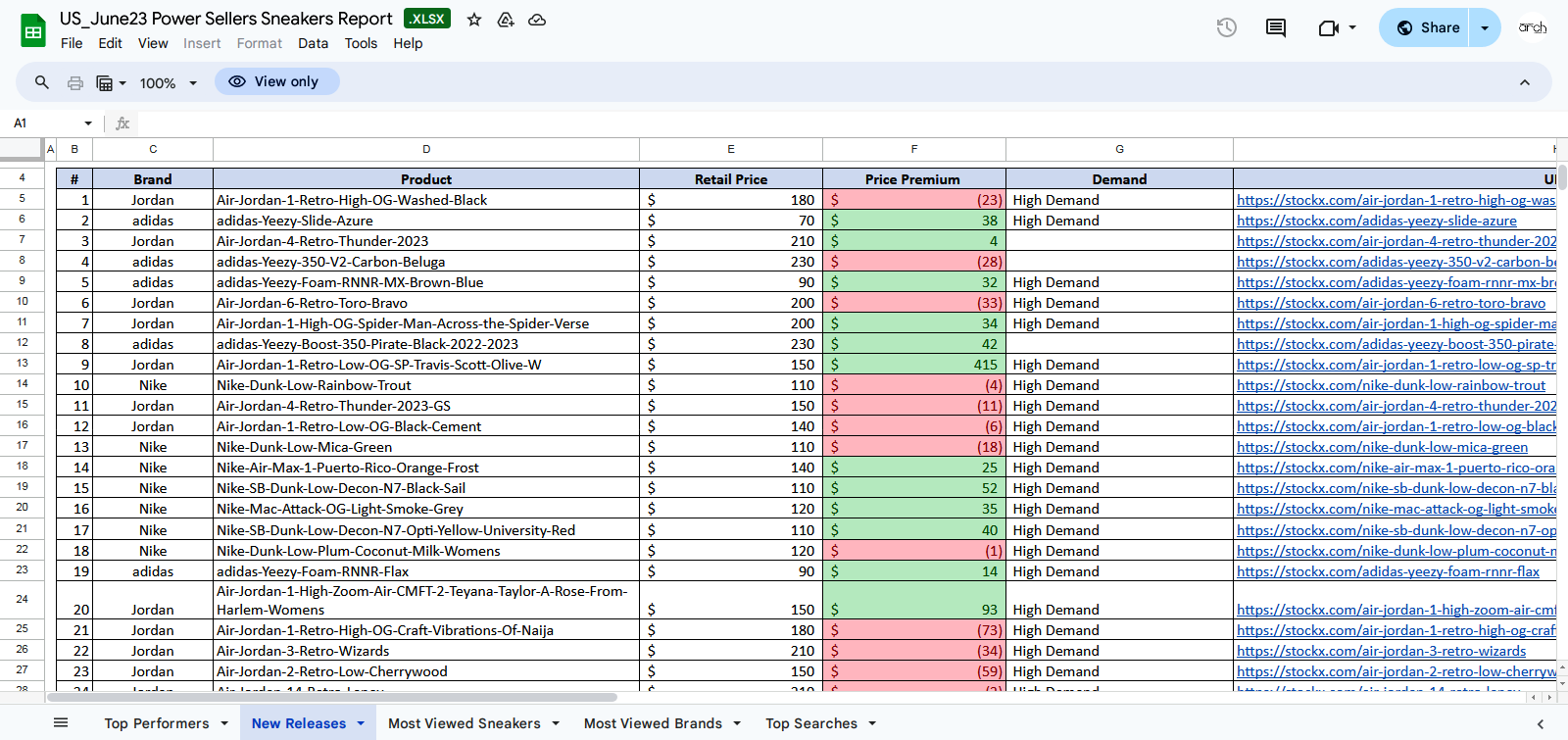

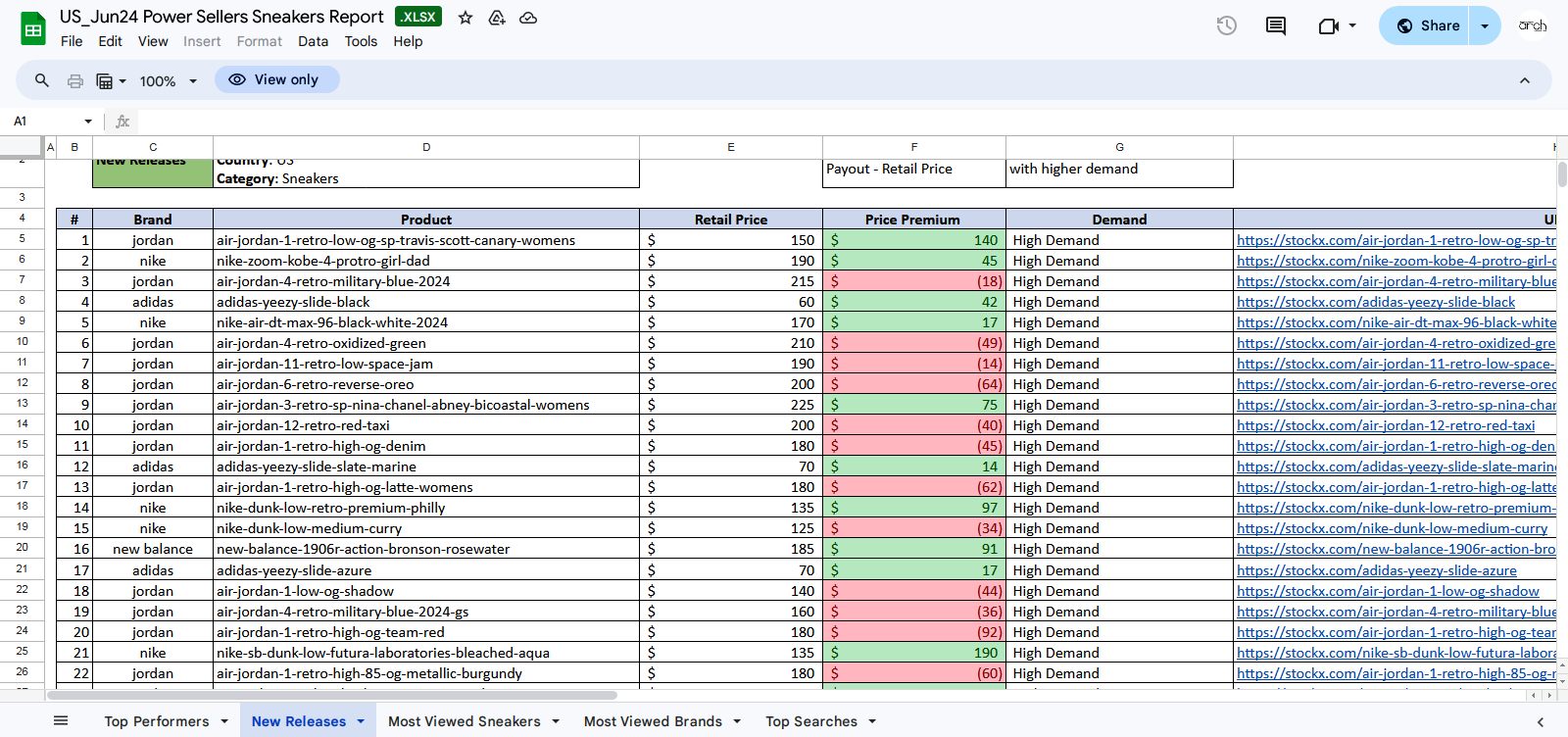

To provide context, let's first review the StockX resale data for June 2023 and June 2024:

Increasing Depreciation

The data reveals a trend in the depreciation of new releases. In 2023, 10 out of 22 new release sneakers were in the red, while this number increased to 12 out of 22 in 2024.

More importantly, the average depreciation on new releases nearly doubled, from -$23.10 in 2023 to -$46.50 in 2024. This suggests that resellers face greater risks when investing in new releases.

Limited Releases Still Reign Supreme

Despite the overall downward trend, limited release kicks continue to be the best performers in both years. This underscores the enduring power of exclusivity in driving resale value.

Deeper Losses

In 2023, some depreciated new sneakers experienced single-digit losses. However, 2024 saw every depreciating new sneaker taking double-digit hits. This indicates a more volatile market with potentially higher stakes for resellers.

Brand-Specific Insights: Air Jordan 1

The Air Jordan 1, once a staple of the resale market, now faces significant challenges. Unless it's a collaboration with a high-profile figure like Travis Scott, new release Air Jordan 1s are experiencing rapid depreciation, similar to a new car's value drop upon leaving the dealership. Even Travis Scott collaborations have seen diminished value in 2024 compared to 2023.

Profitability Considerations

- Focus on Limited Releases: Given their consistent performance, limited releases should be a primary target for resellers looking to maximize profits.

- Careful Selection: With increased depreciation risks, thorough research and selective purchasing become crucial for maintaining profitability.

- Quick Turnaround: The rapid depreciation of many new releases suggests that quick sales may be necessary to capture maximum value.

- Diversification: Relying solely on new releases may no longer be a viable strategy. Resellers should consider diversifying their inventory with vintage or rare finds.

- Utilize the Proper Platforms: METAZ offers the lowest fees, secure sneaker storage, protecting limited releases from damage while preserving their value and instant transactions.

By tokenizing sneakers, the platform enables global trading and more, providing liquidity and quick turnaround options for resellers aiming to maximize profits.

Market Evolution and Future Outlook

The current state of the resale market reflects a correction from unsustainable practices, such as bot-driven purchases and store manager payoffs. While these changes present challenges, they also offer opportunities for the market to stabilize and evolve in all parts of the industry.

In conclusion, while the sneaker resale market faces headwinds, it remains a dynamic and potentially profitable space for those who can navigate its evolving trends and challenges.

Ready to start your collection hassle-free?

Check out our marketplace: https://metaz.io/explore

Custody your sneaker collection: https://metaz.io/custody

Join our community: https://discord.gg/metaz